Table of Contents

Bitcoin Might Be the Next Big Bust

A Historical Perspective

Bitcoin, the pioneer of cryptocurrencies, has enjoyed a meteoric rise since its inception in 2009. Heralded as “digital gold,” it has captivated investors, tech enthusiasts, and financial institutions alike. But could Bitcoin be heading for a crash as dramatic as its ascent? Examining historical financial bubbles and the inherent vulnerabilities of Bitcoin might reveal why it could become the next big bust.

The Echoes of History

To understand Bitcoin’s potential downfall, it’s helpful to look at past financial manias. The Dutch Tulip Mania of the 17th century saw the price of tulip bulbs skyrocket to unsustainable levels before collapsing. Similarly, the South Sea Bubble in 18th-century England promised untold riches from speculative investments but ended in ruin for many.

In more recent history, the dot-com bubble of the late 1990s serves as a stark reminder of the dangers of unchecked euphoria. Companies with dubious business models saw their valuations soar simply for being associated with the internet, only to crash when the reality of their limited profitability set in.

Bitcoin shares several characteristics with these historical bubbles:

- Speculative Frenzy: Bitcoin’s value is often driven by speculative buying rather than fundamental utility.

- Overinflated Expectations: Like tulips and dot-com companies, Bitcoin’s perceived potential may exceed its practical applications.

- Volatility: Wild price swings make Bitcoin more akin to a gambling asset than a stable store of value.

The Fault Lines in Bitcoin

While Bitcoin’s decentralized nature and blockchain technology are revolutionary, several vulnerabilities could precipitate its collapse:

- Regulatory Risks: Governments worldwide are grappling with how to regulate cryptocurrencies. A sweeping ban or severe restrictions—as seen in countries like China—could significantly impact Bitcoin’s value. Regulatory crackdowns on crypto exchanges or stringent tax policies could further erode investor confidence.

- Environmental Concerns: Bitcoin mining is notoriously energy-intensive, with some estimates suggesting it consumes more electricity than entire countries. As the world shifts toward sustainability, Bitcoin’s environmental footprint may render it increasingly untenable, leading to reduced adoption.

- Competition from Other Cryptocurrencies: Bitcoin was the first mover, but newer cryptocurrencies like Ethereum, Solana, and Cardano offer advanced functionalities such as smart contracts and greater scalability. Bitcoin’s lack of adaptability could see it overtaken by more versatile alternatives.

- Market Saturation: As Bitcoin adoption grows, its potential for exponential returns diminishes. Early adopters have already reaped significant gains, leaving newer investors with diminished prospects. This dynamic could lead to disillusionment and a slowdown in investment.

- Loss of Trust: High-profile hacks, fraudulent schemes, and the potential for manipulation in crypto markets contribute to a perception of instability. If trust erodes, Bitcoin’s value could plummet rapidly.

Lessons from the Dot-Com Era

The dot-com bubble offers a particularly compelling analogy. Like Bitcoin, the internet revolutionized industries and created immense wealth. However, only a fraction of dot-com companies survived the crash to achieve long-term success. Amazon and eBay emerged stronger, but countless others faded into obscurity.

Similarly, blockchain technology—the backbone of Bitcoin—may thrive even if Bitcoin itself does not. Industries from finance to supply chain management are exploring blockchain for secure and transparent operations. Bitcoin’s fall would not necessarily spell the end of cryptocurrency but could pave the way for more sustainable and innovative digital assets.

The Inevitable Correction?

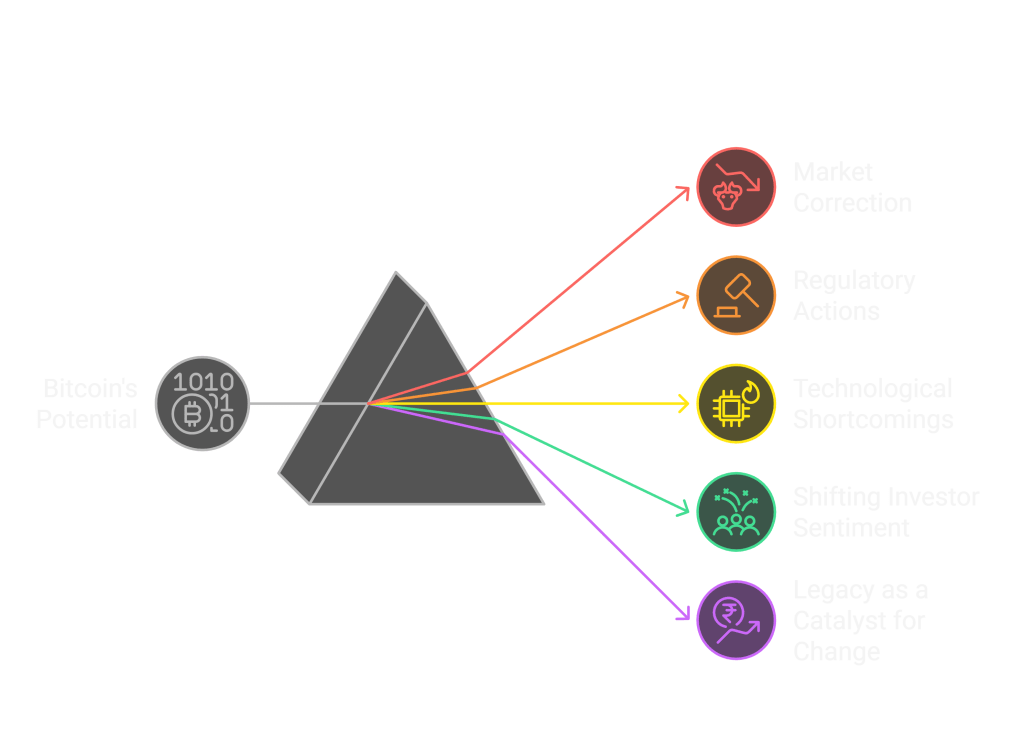

Bubbles typically burst when the gap between perceived value and intrinsic value becomes unsustainable. Bitcoin’s rise to tens of thousands of dollars per coin is largely fueled by speculative enthusiasm, not widespread real-world use cases. A market correction—whether triggered by regulatory actions, technological shortcomings, or shifting investor sentiment—seems inevitable.

Bitcoin’s story is one of innovation, speculation, and volatility. While it has undoubtedly reshaped conversations about money and decentralization, it remains vulnerable to the same forces that have undone speculative assets throughout history. Whether Bitcoin thrives or crashes, its legacy will endure as a catalyst for change in the financial world. Investors and enthusiasts should tread carefully, remembering that even the brightest stars can burn out.